How it works, what’s changing, and what Staff Specialists need to know

1. Context: The NSW Award structure is not likely to change.

The Australian Salaried Medical Officers’ Federation (ASMOF) has recently submitted its proposed Public Hospital Doctors (State) Award 2024 to the NSW Industrial Relations Commission (IRC) as part of a wider legal challenge to the existing NSW Staff Specialists (State) Award and the rights of private practice arrangements.

Although the proposal includes extensive changes to pay rates and employment conditions, the fundamental structure of Staff Specialist rights of private practice remuneration remains the same. The components that make up a Staff Specialist’s salary — including the Award Rate, Special Allowance, Private Practice Allowance (PPA), and Right of Private Practice (RPP) drawings — remain unchanged in principle.

In all likelihood – and irrespective of the outcome of ASMOF’s case before the IRC – the NSW Staff Specialist Award framework with regard to Right of Private Practice is going to remain the same for the foreseeable future.

The full ASMOF submission has not been publicly released, however ASMOF members have access via their member portal and a public summary is available here.

This article summarises the current arrangements under relevant NSW Health publications and policies.

2. What makes up a Staff Specialist’s income in NSW?

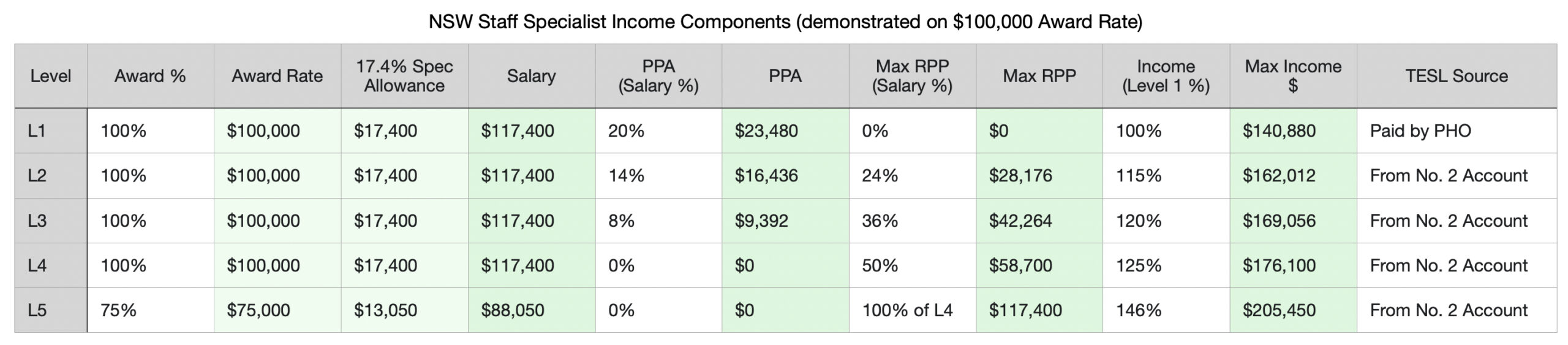

The total Income for a NSW Health Staff Specialist includes several key components:

- Award Rate – the base salary defined in the Staff Specialists (State) Award.

- Special Allowance (17.4%) – paid in addition to the Award rate.

- Private Practice Allowance (PPA) – paid by the employer, not connected to private billings.

- Right of Private Practice (RPP) drawings – income derived from private patient billing.

- Guaranteed Supplemental Income – a form of safety net if private billings are limited (will not be covered here)

The crucial distinction is that PPA is employer-funded, while RPP drawings depend on actual private patient revenue.

Source: NSW Health. Staff Specialist Determination 2015.

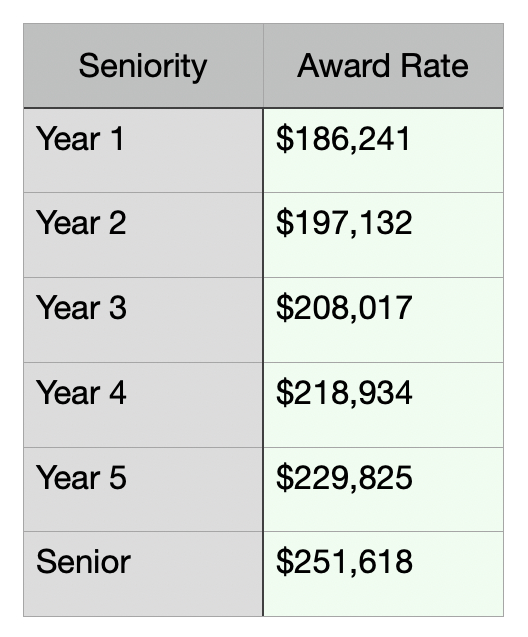

The NSW Government determines the actual Award Rate and indexes it every financial year. The Award Rate scales with increasing Seniority (i.e the time worked in years as a specialist). It is important to note that the Seniority scale is different and unrelated to Level Election for RPP purposes. All RPP levels (Level 1 to Level 5) have the same Seniority grading scale comprising 6 steps – Year 1 to Year 5 and Senior.

The Award Rate increments in accordance with Seniority – i.e. the years employed as a Specialist.

For RPP Levels 2 to 4 the Award Rate for a given Seniority is 100% of the corresponding rate on Level 1. (e.g. Level 4 Year 1 = 100% Level 1 Year 1)

For RPP Level 5 the Award Rate for a given Seniority is 75% of the corresponding rate on Level 1. (Level 5 Year 1 = 75% Level 1 Year 1)

Eligibility for Senior Staff Specialist rates requires completing 3 years on the maximal (Level 5) Award Rate – i.e. a total of 7 years. Requires to be nominated and appointed as a Senior Staff Specialist by the Medical Appointments Advisory Committee.

Source: NSW Health. Staff Specialist (State) Award Salary Increases and Staff Specialists (State) Award 2022

Important to note:

The Award Rate and Special Allowance together make up the Salary- all allowances are calculated on the Salary.

Superannuation is paid on all components of the Staff Specialist Income other than RPP Drawings.

Tax is deducted by the employer from all components of Staff Specialist Income other than RPP Drawings. (Accounting and tax payable on RPP drawings is the responsibility of the Staff Specialist)

Source: NSW Health. Staff Specialist Determination 2015.

3. What is the Right of Private Practice?

Right of Private Practice (RPP) gives Staff Specialists the ability to earn additional income from treating private patients within public hospitals.

Under NSW Health’s model, the Local Health District (LHD) bills and collects private fees on behalf of the specialist. The specialist then receives drawings from those funds (up to their elected level limit) after the required deductions are made.

At its core, RPP is both a revenue stream and a cost-sharing mechanism between clinicians and the public health system — recognising the infrastructure provided by NSW Health while rewarding clinicians for generating private income.

4. How private patient revenue is collected and managed

Private patient billing follows a defined process:

- Billing:

- The Staff Specialist determines which MBS item numbers are claimable.

- The LHD billing team generates and submits invoices on their behalf.

- Collection:

- Payments are deposited into a special purpose account (the No. 1 Account).

- Deductions:

- The Facility or LHD deducts a facility or infrastructure fee first (e.g., ~20 % in most ICU departments).

- The account may also cover approved expenses such as medical indemnity and partnership accounting fees.

- Drawings:

- The remaining balance is available for RPP drawings, up to the elected Level’s maximum.

- Rollover:

- At the end of the financial year, any unspent balance is transferred to the No. 2 Account, which funds TESL and other approved expenditure.

Source: NSW Health. Staff Specialist Determination 2015. and Staff Specialist Rights of Private Practice Arrangements 2017

5. The No. 1 and No. 2 Accounts explained

No. 1 Account – Private income and drawings

- Receives all private billing income for Levels 2–5 Staff Specialist(s). Either individual or Group account.

- Pays the infrastructure/facility fee, approved admin or accounting costs, and medical indemnity.

- RPP drawings are paid directly to the specialist(s) from this account.

No. 2 Account – Departmental and TESL funds

- Holds rollover funds from the No. 1 Account. Either individual or Group account (to align with No. 1 account setup)

- A committee approves the expenditures.

- Used for Training, Education and Study Leave (TESL), and other approved expenditure. We will cover TESL and No. 2. Account disbursements in a separate article.

6. Levels 1–5: How election affects pay and benefits

Every Staff Specialist elects a Right of Private Practice level each financial year (normally effective from 1 July), known as Level election. The Level election determines both your access to private practice income and the proportion of your salary subsidy provided by the PHO / LHD (in the form of the PPA).

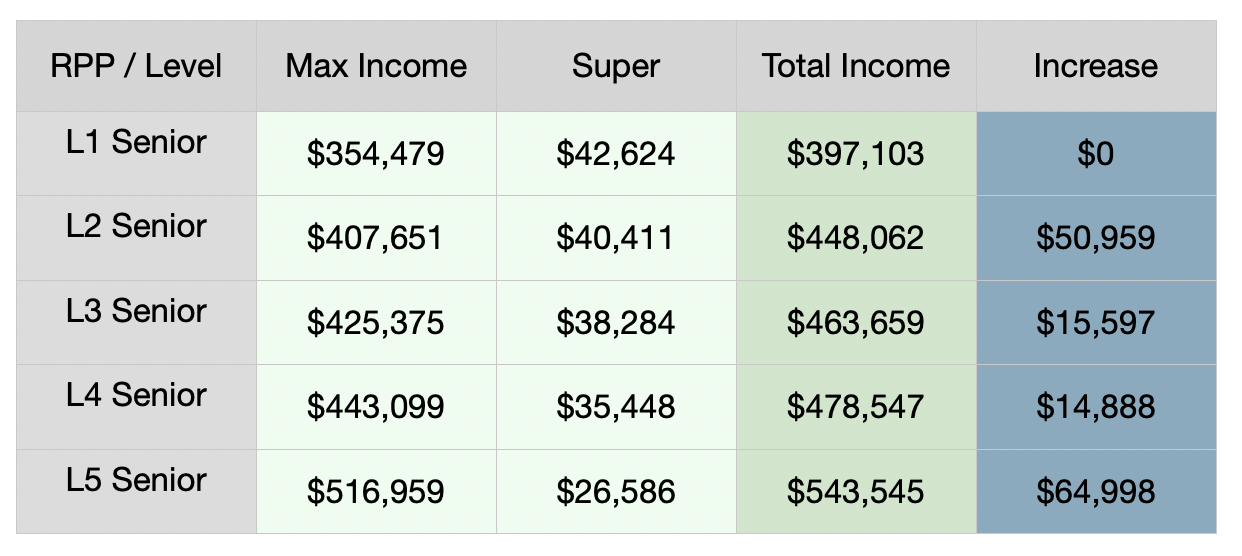

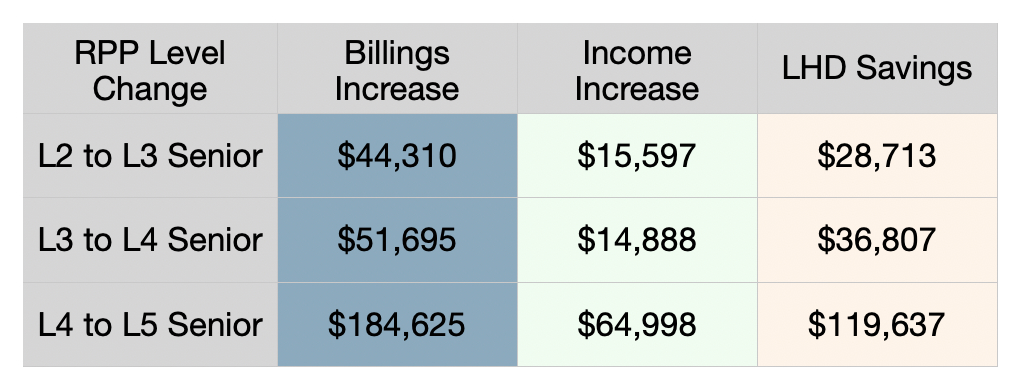

Incremental increases in Income are not uniform between RPP Levels. There is a large jump going from Level 1 to Level 2 and also from Level 4 to Level 5, the increments are much smaller going from Level 2 to Level 3 or Level 3 to Level 4.

Source: NSW Health. Staff Specialist (State) Award Salary Increases

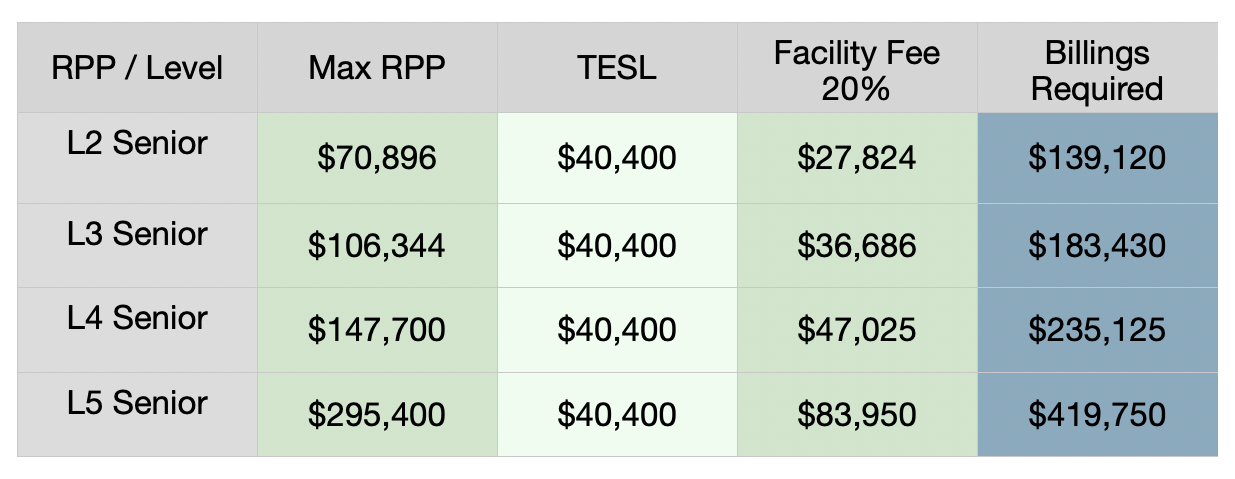

Private Patient billings required to achieve RPP Level

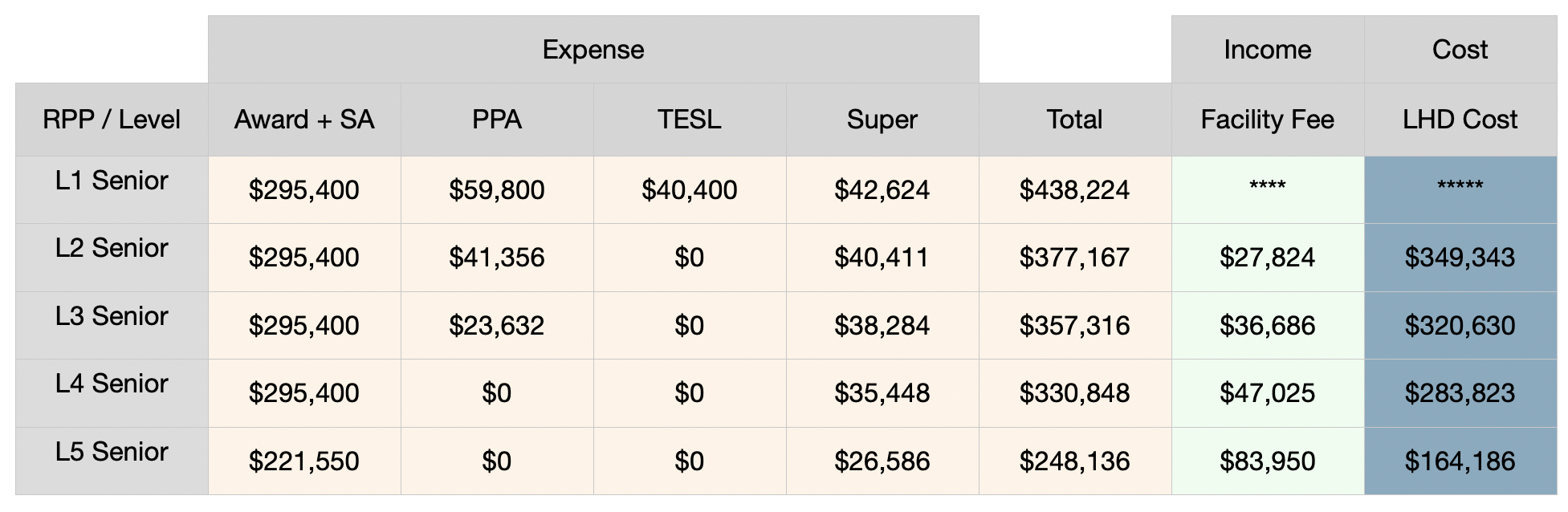

Cost of a full time (1.0 FTE) Staff Specialist

The Income at each increment of RPP Level has a larger component reliant on Private Patient billings. Higher volume Private Patient billings also result in more revenue in facility fees. In practical terms this means that from the perspective of the PHO / LHD the salary related expenditure is inversely proportional to Level election (i.e. the higher the RPP Level election, the less a Specialist employment costs the PHO / LHD).

- TESL is only paid from PHO / LHD budget on Level 1. On higher Levels it is paid from the No. 2. Account (so in essence from private patient billings)

- PPA decreases progressively and is completely absent on Level 4 and Level 5

- Super is paid on Award Rate, Special Allowance and PPA – so super payable also progressively decreases with increasing RPP Level election.

- The Facility Fee charged by the PHO / LHD increases with increasing Private Patient revenue.

- Going from RPP Level 2 to Level 5 the cost of 1 FTE Staff Specialist reduces by over 50%.

Who benefits from higher Right of Private Practice Level election?

When going up a level in RPP election, any given increase in income also coincides with a significant reduction in the salary related expense to the PHO / LHD which means that the actual increase in Private Billings required to sustain the higher RPP Level are several fold the actual Income increase.

The exact net effect of changing from Level 1 to Level 2 is less straightforward to predict as it largely depends on Private Patient billings, which on Level 1 are entirely channeled to the PHO / LHD without any allowed RPP Drawings.

Key takeaways

- L1: No RPP income, but PPA is largest. TESL is funded directly by PHO / LHD (e.g., $40,400 p.a. for 2025/26).

- L2–L5: RPP drawings increase and PPA decreases progressively – completely absent on Level 4 and Level 5.

- The structure ensures that as clinicians earn more from private practice, the employer’s salary contribution reduces, effectively splitting the benefit of increased private revenue between clinician and hospital.

7. Choosing the right RPP level

a) Model your expected private income

If your actual billings are at risk of falling short of the level’s maximum drawings, you could end up earning less overall on a higher RPP Level, because the PPA component has dropped and a larger proportion of your income is now dependent on the private patient income stream. Reaching a comfortable buffer (i.e. a reasonable end of financial year rollover into the No. 2. account) is usually suggested before considering a higher RPP Level election.

b) Consider your team’s structure

Combined No. 1 Accounts make sense for departments like ICU, where some rostered duties (e.g., MET calls, outreach) don’t necessarily generate private income that would be expected whilst working in an ICU POD. Pooling smooths fluctuations from elective lists and holidays. Sharing the benefits evenly reduces possible friction.

c) Review TESL implications

Electing higher RPP levels can mean more drawings but reduced or zero rollover to the No. 2 Account — potentially reducing overall departmental TESL funding availability.

Available funds in the No.2. account should be carefully evaluated. If you have a healthy No.2. account balance, you can likely afford minimal or zero rollover for a financial year or two, whilst enjoying higher income at a higher RPP Level. If however your No.2 account is low on funds, having no leftover billings to roll over may limit your access to funding TESL activities in the coming years.

d) Election timing

Levels can normally only be changed once per financial year unless exceptional circumstances apply. In combined accounts, all members must elect the same level.

8. Key points for Staff Specialists

- PPA is unrelated to billings — it’s an employer-funded allowance on lower levels of RPP.

- Right of Private Practice drawings are derived from private patient income and they are subject to facility-fee deductions.

- No. 1 Account handles RPP income and allowable costs; No. 2 Account supports TESL and professional development.

- Level election matters: higher levels offer increased income but greater variability and risk.

- Private Patient Revenue is essentially shared – financial benefits are split with the employer.

- Combined accounts balance fairness and risk in team-based specialties like ICU.

References

- NSW Health. Staff Specialists (State) Award 2022.

- NSW Health. Staff Specialist Determination 2015.

- NSW Health. Staff Specialist (State) Award Salary Increases

- NSW Health. PD2017_002 – Staff Specialist Right of Private Practice Arrangements.

- NSW Health. IB2025_034 – Staff Specialists’ Training, Education and Study Leave (TESL) – New Funding Entitlement 2025/2026

- ASMOF NSW. Proposed Public Hospital Doctors (State) Award 2024 (submitted to IRC). Public summary.

Disclaimer

This blog is provided for educational and general informational purposes only and does not constitute legal, medical, or financial advice. While every effort has been made to ensure accuracy, billing requirements under the Medicare Benefits Schedule (MBS) are complex and subject to change. Clinicians should always consult the official MBS, relevant hospital policies, or seek independent professional advice before making billing decisions. While we use reasonable effort to ensure that our overview articles are accurate, current and complete, we do not represent, warrant, or guarantee (to the maximum extent permitted by law) their accuracy, currency, or completeness or imply that they are applicable to your individual situation. ClaimLogic accepts no liability arising from for actions taken based on the content of this article.